- ND Capital Network

- Posts

- The Golden Tenets of Bull Runs

The Golden Tenets of Bull Runs

The 10 Core Principles To Live By In A Bull Market

Use this as a governing set of rules for whatever you decide to do in a bull market.

If you only follow these rules, you will be successful.

Deviate from these rules and you’ll find yourself in a bad spot.

1. Take your damn profits

In crypto, your money could go from 10 → 0 just as quickly as it can go from 0 → 10.

It’s a beautiful yet dangerous thing.

That’s why, the most stupid thing someone can do is brag about their unrealised profits.

Because it’s all on paper.

And it could go poof in just a few short days.

This is the performance on one of my accounts:

It went from $28k → $21k just as quickly as it went from $23k → $28k

I was on cloud nine just a few days ago.

Now I no longer am.

Take your profits or the market will take it from you.

The best way to do this without knowing any TA is to understand the numbers:

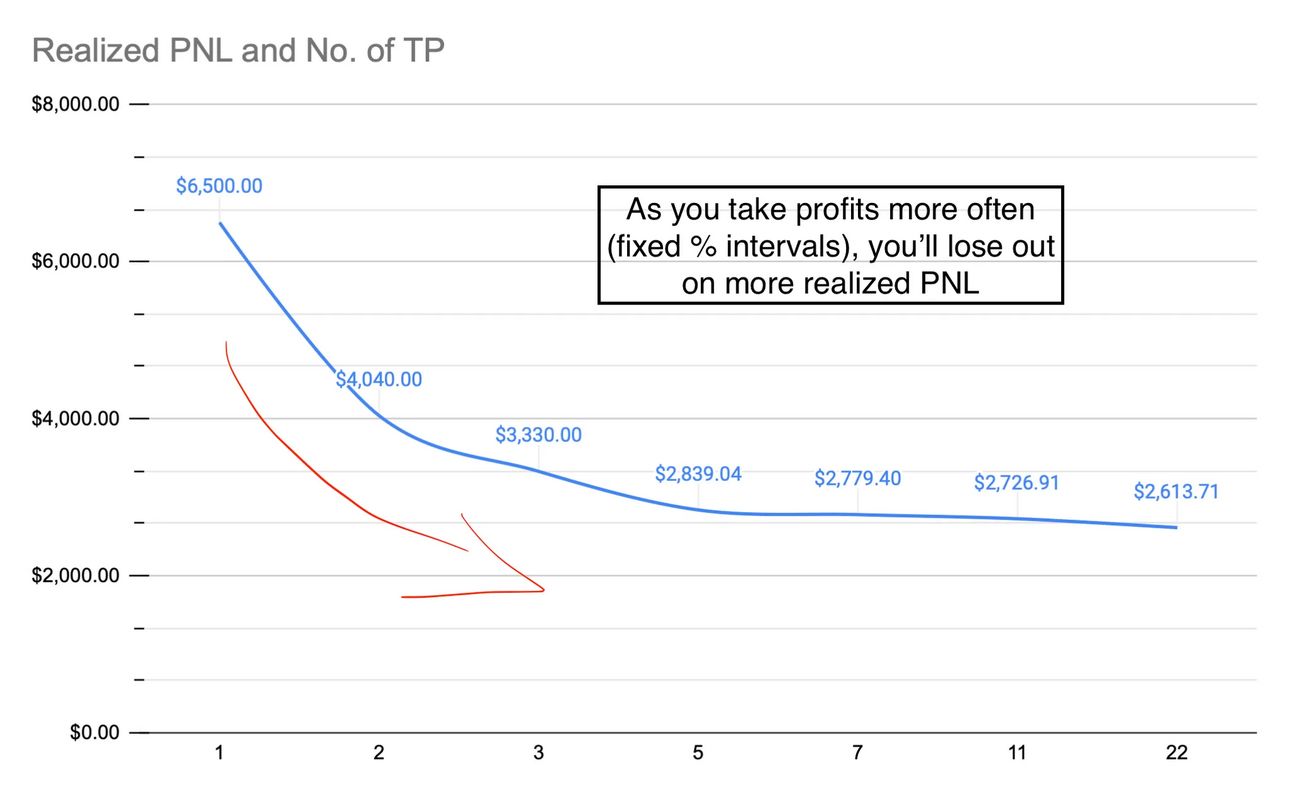

Punching in the numbers

Let’s go back in time a bit to the 2020 to 2021 bull run.

Imagine you bought Bitcoin (BTC) at an average price of $10,446 with $1,000 (change in market structure / bullish sentiment kicking in).

Then, when the price hit its highest point during a big increase in 2020-2021, it was $69,000. This means the price went up about 6.61 times, which is a 561% increase.

We looked at different ways of selling Bitcoin at different points to see what would give us the most profit.

And we also excluded ALL other external factors but price in this simulation.

Because we want to see if it’s possible for someone without ANY knowledge in the crypto / trading space to use a copy and paste profit taking strategy.

So here’s what we found:

Our analysis revealed an interesting trend: the more frequently you sell (take profits), the lower your overall profits tend to be.

This makes sense because selling more frequently means you have less to sell when the price is at its highest.

Here’s the catch

If you avoid selling too often, you're taking a bigger risk.

According to this, optimal profit taking is achieved by either selling close to the peak or dividing sales into fixed intervals.

Yet, this approach isn't practical for everyone as it requires a deep understanding of the market and the ability to make accurate projections.

And not just blindly believing every crypto influencer that’s shilling you $100k BTC lol.

We also did this for other assets (ETH, SOL, AVAX etc…)

The results were similar and can be summed up into one sentence.

“If you plan to latter out your profits every time price moves up, without taking on too much risk, you’d be better off taking profits often, but take small chunks each time.”

And the reason that we can’t give you a fixed percentage is because a key factor in the equation is the selling price at the top.

Which we know that it’s impossible to predict.

So what now?

Crypto markets are unpredictable, so if you wait too long, you might end up losing money.

The best way to make money is to find a balance between selling enough times to make a good profit and not selling too often.

It depends on how confident you are that the price will go up.

So having a rigid system might not make sense.

But before we draw conclusions.

Let’s weight the Pros and Cons:

Pros

You have a system where you know exactly how much to take at which price point.

You can literally set your TPs in advance without worry.

HOWEVER…

Cons

You have to essentially predict where price is going.

If the bull market does not happen, your plan would be invalidated pretty quickly.

That is why…

The real way to do this is to actually understand TA and fundamentals on a deeper level:

Has price hit a key level?

Is it starting to show signs of reversal?

Is there still room to go based on price action?

How’s market sentiment right now?

Any news that might turn the tides?

Taking all of those factors into consideration and making a thesis based on your understanding of everything is how you really maximise your profit potential in a bull market.

But otherwise, data can be good for the passive investor.

And remember…

You are not making money in crypto.

This is a zero sum game.

You are either taking money from other people or other people will take your money from you.

And HODL is a scam.

The only fate that awaits people who “diamond hand” is -90% portfolio valuation.

99% of crypto is trash.

There is no real use case other than the fact that it’s good for making money.

They will eventually fall by 90% valuation and you’ll be the idiot holding on to trash.

Additional note:

When it comes to “moonbags”, there are 2 rules you must follow:

They should not consist of large caps, only small caps / mid caps.

You should’ve already taken 50% or more profit out of your whole position before leaving them to run

Example: Many people in the last run did not sell any of their Bitcoin because they thought it was going to $100k.

They ended up with nothing.

Sure, ETH might flip BTC and SOL might flip ETH.

But that’s more of a 10-year thing or a 5-year thing at a minimum.

Don’t let the opinions of the masses screaming for a $1,000 SOL keep you from taking at least 50%-75% of your profit and letting the rest run.

You can always buy back lower or momentum trade using the TA module I gave you earlier in this masterclass.

2. Do NOT fade the trend

The price has pumped 100% in the past 2 weeks.

You feel it's "too expensive," and you wait for a correction that never comes.

It pumps 10x further because it's a bull market.

You wouldn’t pay $100 for an apple in a supermarket.

But crypto is not a supermarket.

There is no such thing as “expensive”.

There is only uptrend or downtrend.

And in a bull market, it’s usually an uptrend most of the time.

Meaning:

Buy dips or

Buy high, sell higher.

In bull markets you must think in 10x orders of magnitude.

Think 1,000% instead of 100%.

It’s 2x up? Well, that means it has another 800% to go.

On another note: You are never too late.

Often times I see beginners miss the “perfect” entry on a coin and just outright give up.

Only to come back a month later to see that if they would’ve just entered anywhere during the pump…

They would’ve made a cool 5x.

Sure, a 10x is not comparable to a 5x.

But 5x is better than nothing especially when money is this easy to be made right now.

Let go of your fear of losing money / perfectionism.

(Extra learning material for trading psychology: The Trading Psychology podcast)

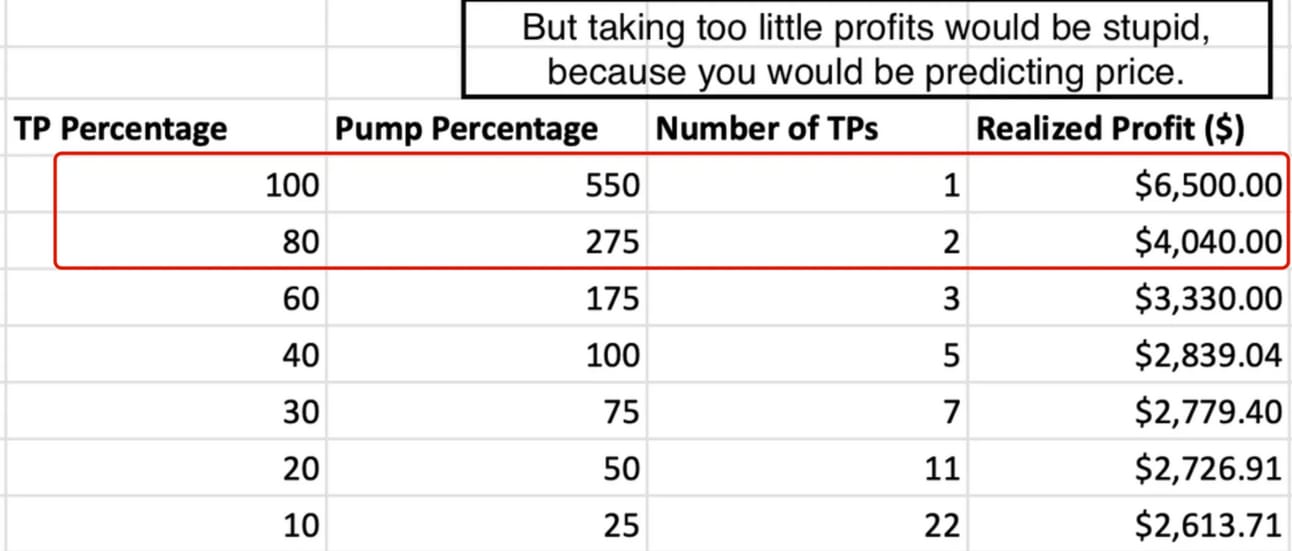

3. Pumpmentals > Fundamentals

Bull markets are all about speculation.

Look for projects that:

Can generate hype

Have a simple to understand STORY. Can people understand WHY the future prices will pump?

Fundamentals don’t matter in a bull market.

Don’t be a contrarian in a bull market.

It can be tempting to do so especially when you feel like you’re already late to a narrative / don’t believe in that narrative.

But they are narratives for a reason.

Because the majority of people in the markets believe in it.

A rule you’ll learn later down this list is the rule of riding your winners hard and cutting your losers short.

There are only a handful of narratives that are responsible for 80% of the gains in a bull market.

And they continue to stay the kings for longer than you could possibly imagine.

Do not fade pumps. And do not fade narratives.

Always follow the pumpmentals.

4. Rotation timing

In a bear market, narratives would come and go within a few days.

Why? PvP environment + lack of new liquidity = Fast musical chairs.

Narratives last much longer in bulls due to more liquidity. Don't rotate yourself out of profits.

A good “rule of thumb” is giving yourself at least 3 months before you think about rotating.

This is how long the average quarterly cycle lasts in a bull market.

Bonus material: Quarterly Theory

On another note:

Bear market is PvP while bull markets are PvMe.

The only thing that holds you back in a bull market is yourself.

Your fears, uncertainties and doubts.

Which usually ends up with a fear of losing money as the root cause.

Overcome them with discipline, psychology and risk management.

This also leads me on to my next one:

5. Lower your IQ

The paradox of a bull market is that while opportunities abound…

The abundance of information can lead to paralysis by analysis.

Most people often get hindered by the overwhelming plethora of:

Signals

Indicators

Opinions

Events

… hindering their ability to make clear-headed decisions, or even just a decision in general.

Lowering your IQ in this context means to simplify your approach, instead of overanalysing:

Have a clear system with clear triggers and execution steps and follow it religiously

Focus on your zone of expertise and nothing else

Get rid of your perfectionism. Take profits on the way up and market buy as long as it fits your risk management scheme

6. Find your Edge

“Try to catch 2 chickens and you’ll catch neither.”

The most money is made in any industry when you deploy focus.

Instead of reading into 10 different narratives, focus on 2-3 that you understand really well.

This is called your Zone of Expertise.

Look no further than Warren Buffett as the best example of the outsized returns you can get when you simply deploy focus.

The internet and the tech space was cool but Warren Buffett’s zone of genius was Coca Cola and traditional companies.

Many made billions and trillions out of the “new age” stuff.

But 99.99% of them still underperformed compared to Warren’s simple, sound investment logic and singular focus in his zone of expertise.

LRTs and AI are cool but my zone of expertise is L1s and gaming.

That is how I made most of my money during the last bull market.

And I am positioned to repeat it all over again this time around.

There are also people who’ve made 8-figs ++ with memecoins, AI and NFTs.

Meanwhile I’ve lost half a million dabbling in NFTs (true story).

Stay in your own lane. Work towards mastering your zone of expertise. Focus.

And you’ll end up realising much more profit by the end of the bull run than you could think possible.

7. Ride your winners hard and cut your losers ASAP.

In terms of executional ability / psychology of investing or trading…

This is the most powerful concept out there.

Most people who are operating from a standpoint of fear (of losing money) will tend to:

Hold on to losers for too long

Cut their winners too early

Either because they cannot accept realising the loss, or bear to lose their unrealised profits.

If you do the opposite of this, you will gain an order of magnitude more success.

At any given point, there are always hard winners.

Coins that are pumping at a rate which makes absolutely no sense.

Make those coins your focus.

Because you will get outsized returns in very little time.

What do I mean by that?

Coins that are already pumping and have narrative support will continue to move straight up in the near future.

That means getting in at any point allows you to achieve returns without the need of waiting for that coin to do “break out” or start moving.

There are times when you should get in early, of course.

But do not base your entire strategy around getting in “early”.

There are immense benefits to simply hopping onto trains that are already moving.

And as previously discussed, you do not need to be perfect.

Simply momentum trade it based on the TA module that you’ve already learnt.

On the flip side, how many times have you found yourself holding onto a coin that is doing nothing / dumping while everything else is going up?

What do those coins usually end up doing?

Nothing.

They almost never catch up to their outperforming peers.

The solution:

Allocate some money to placing early bets, but do not ignore trains that already have momentum behind them.

On another note.

A question most people tend to wonder at some point is:

“What do I do with my coins that are doing nothing but I’ve bought a long time ago?”

The framework for answering that question comes down to:

What is the opportunity cost?

Meaning:

You holding on to that underperforming coin is tying your capital up.

Which means you cannot afford to take other positions that might give you a better return.

So, if you have almost zero free capital to deploy into a worthwhile opportunity (in your eyes), it’s usually a safe bet to cut your loser to invest into the potential winner.

If you have free capital lying around, you can afford to let that underperforming coin sit around for a bit longer.

But in general, a potential 50% gain on that underperforming coin that might take months to play out vs investing your money into a trending narrative coin (AI, gaming, L1, memecoin, LRT etc.) and seeing a 50% return in a couple weeks is going to be the better move.

Best Loser Wins - Tom Hougaard

8. Concentration > Diversification

Having portfolios > 25 coins doesn’t work.

You cannot keep up with that many projects.

And if a coin does moon, you won’t reap as much rewards because you couldn’t allocate as much as you want to.

Concentrate.

I find the sweet spot between 5-10 projects.

In the last bull run, the majority of my gains came from 4 projects:

BNB

AXS

SOL

AVAX

Example of a simple portfolio:

Long-term: SOL, ETH and large-cap beta play

Narrative 1: An Alpha and Beta Play

Narrative 2: An Alpha and Beta Play

Narrative 3: An Alpha and Beta Play

Adjust the % and # of holdings based on your risk tolerance.

My personal example:

Long-term: SOL and ETH

Gaming: IMX & seed investments from Neo Tokyo, SFUND and other mastermind

AI: TAO and FET

L1s: (both beta plays since I already have allocation in terms of L1s in long-term bag) AZERO and ROOT

Rest are swing trades

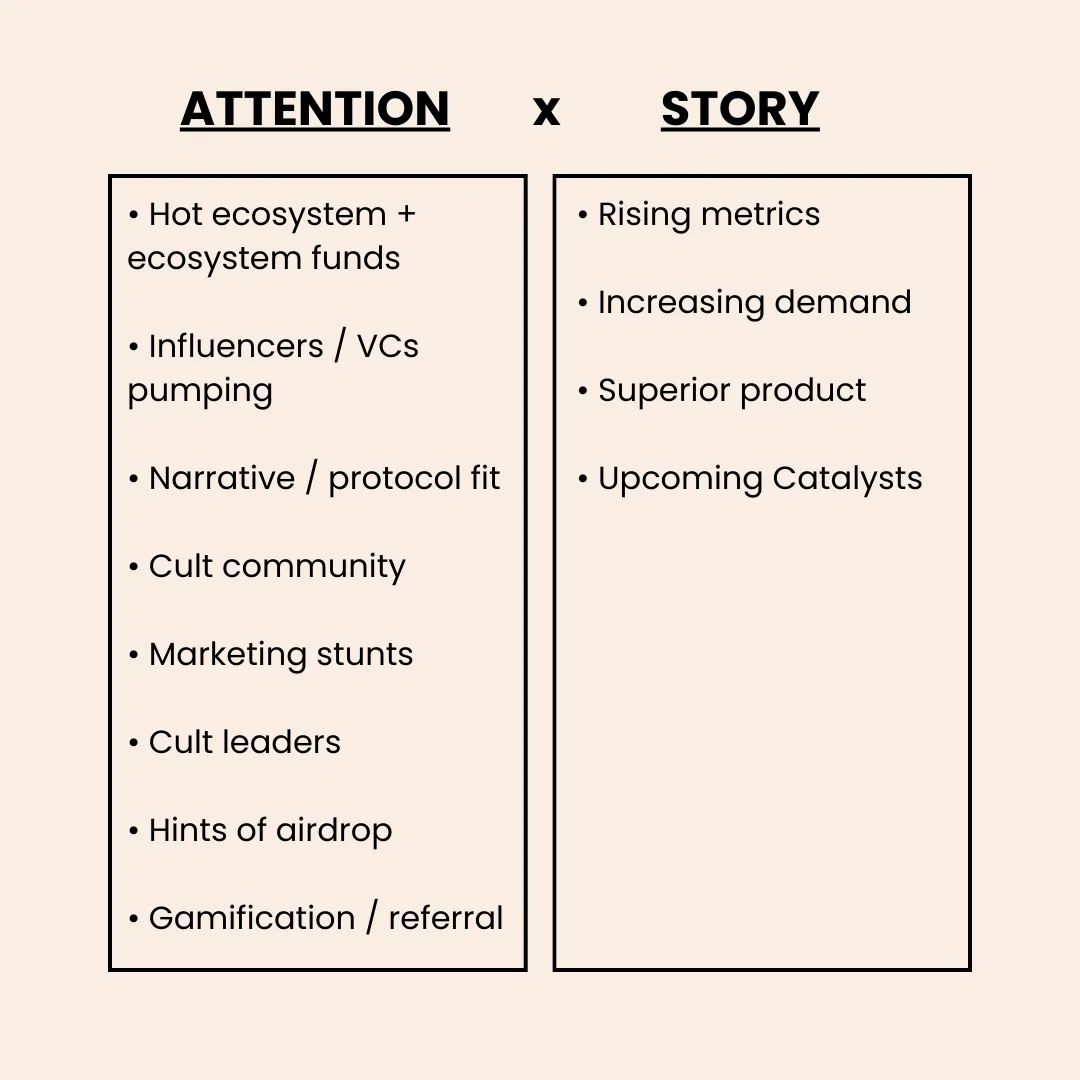

9. Have a plan or plan to fail

This means 2 things:

Have an exit plan

Have an entry plan

We’ve already discussed the importance of exiting, so let’s talk about entry plans.

This can be simplified into having a plan to buy dips.

Because they will always happen.

Just in the last cycle alone, Bitcoin pulled back by at least 20% 8 times.

And what that means for the rest of the market is at least 30%-50% worth of pullbacks…

8 times throughout the cycle.

The funny thing is… everyone always complains when the markets are going straight up saying that there are no dips to buy.

But when the dips come, they get fearful and do nothing.

And the cycle repeats itself.

Solution:

Set alerts on TradingView for when dips happen.

Having a plan and mental preparation for these dips and executing regardless of how market sentiment looks like.

10. Don’t be a cotton picker

My favourite saying of all time in the markets is:

“Top pickers and bottom pickers often become cotton pickers.”

All this means is that people who try to time tops and bottoms end up making nothing - or in most cases - losing everything and having to work at McDonalds.

We’ve already discussed the importance of overcoming your perfectionism.

But this phrase alone will help you make much more money in a bull market.

Not trying to catch tops means you’re actively riding the trend.

Not trying to time the bottom means you have a plan to buy dips.

If you only do these 2 things right, you will be alright.