- ND Capital Network

- Posts

- The Chartist Manifesto: Q4 Edition

The Chartist Manifesto: Q4 Edition

Table of Contents

Bitcoin - The King

Seasonality - Q4 tends to brake bear faces

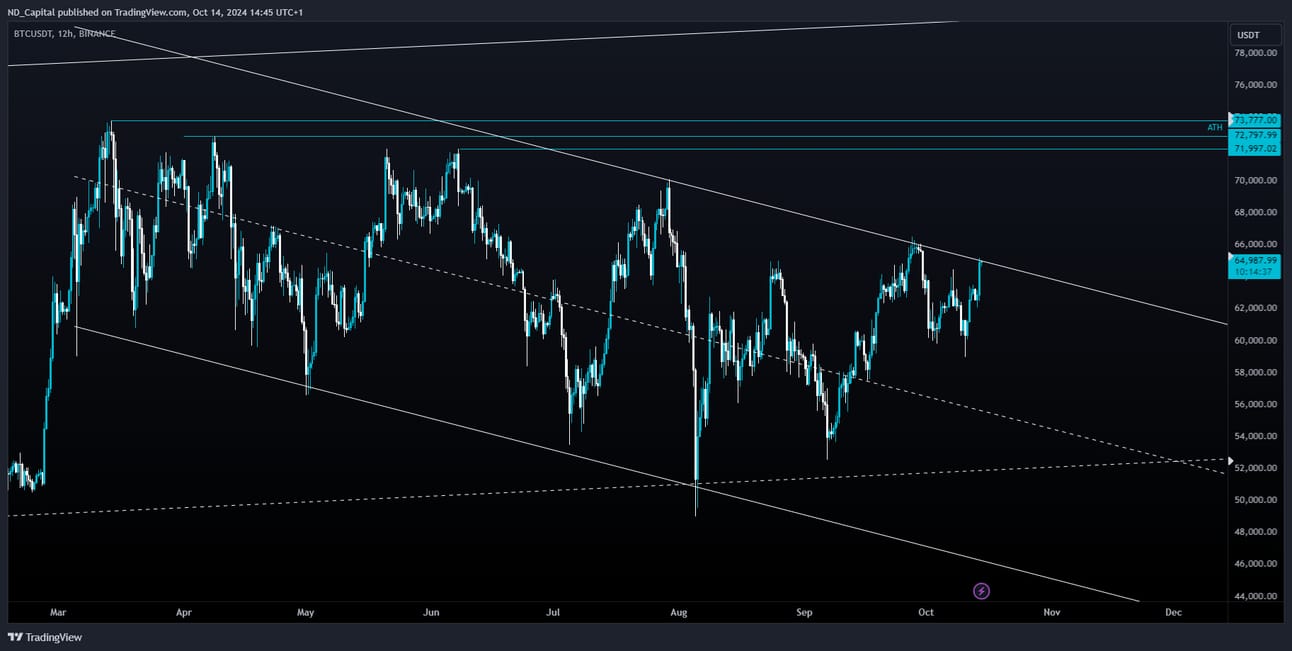

8 Months of consolidation with a very big probability of reaching new ATH by December using statistics - From end of 2017, all the way until today, there have been a total of 25 macro consolidations, with an average duration of 11.4 weeks and a standard deviation of 8.49 weeks. The current duration of 31 weeks therefore has a Z-score of 2.3086, which corresponds with a 95%+ chance of breaking out in the next 4 weeks.

Recently 2 tests of Value Area Low /w Defending the VA while creating HH & HL

Big Bullish CVD = Absorption of Market Shorts from Limit Longs

Bullish Daily + Weekly Directional Bias

This box is the first pit stop where it is wise to hedge your longs but I would not really be worried , besides I would love to see price chop around the range POC before going higher parabolic. People have forgotten that $BTC likes to do 5-8-10% per day and it is the king of volatility. Heres my advantage using the TPO charts , Trending days, Volume Profiles, PO3 candles gives me edge 80% lack. However we are here to make money and trade, not be chartists or analysits.

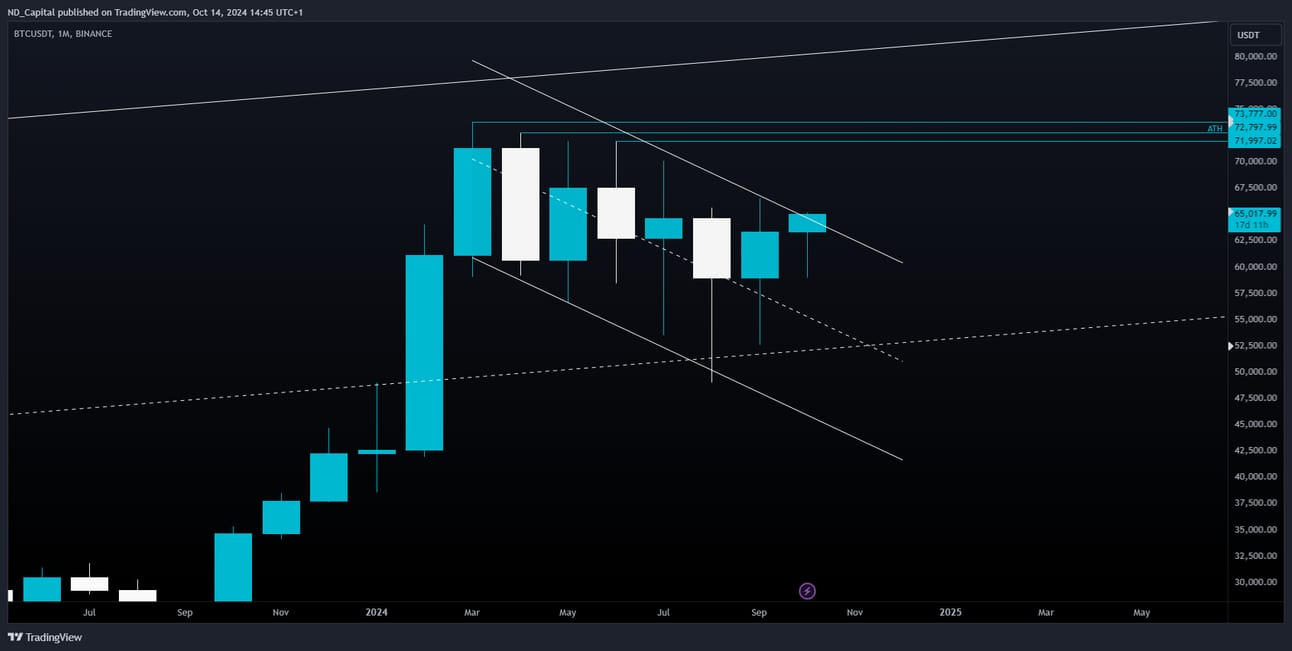

On another the Monthly Point of View there is no stop for the king until 80K

I have been openly bullish in the public that 59+60k is the Low of Q4 2024. Do you believe me now?

There are 3 categories of people…

1 - Those that see

2- Those that see after its shown to them

3- Those that don’t see

Confucius used to say “ You cannot teach someone unless they seek knowledge” or as I like to say it… You can bring the horse to the river, but you cannot make the horse drink water.

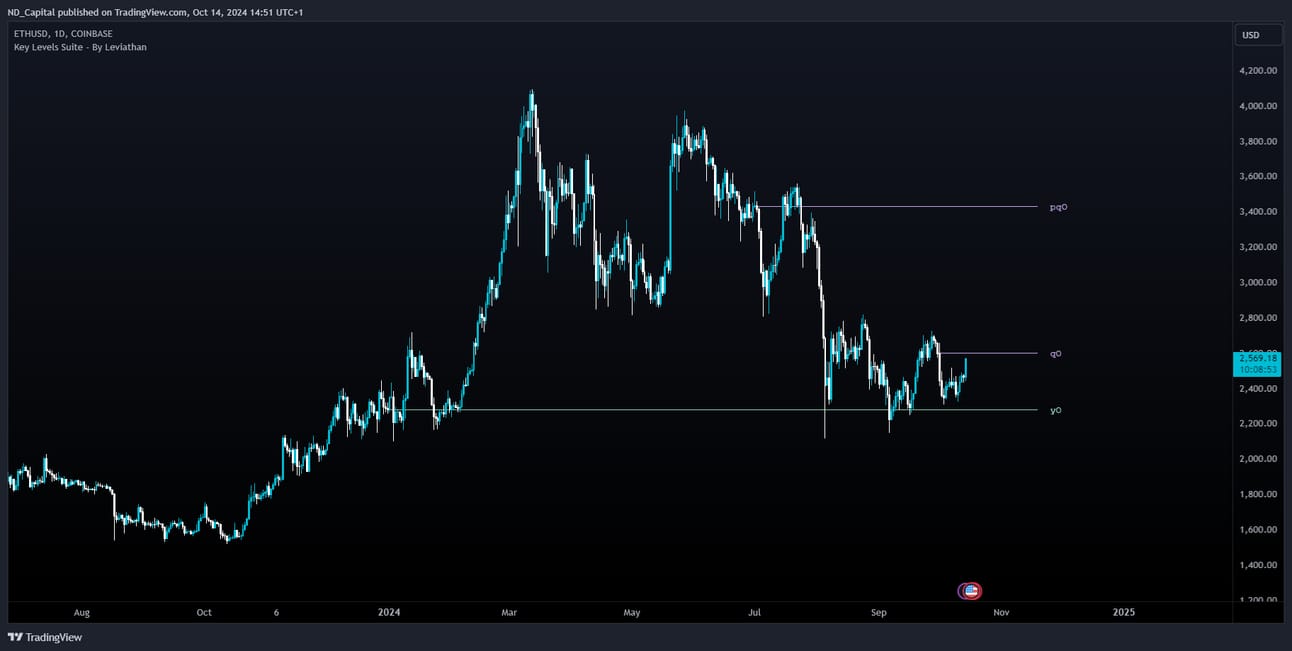

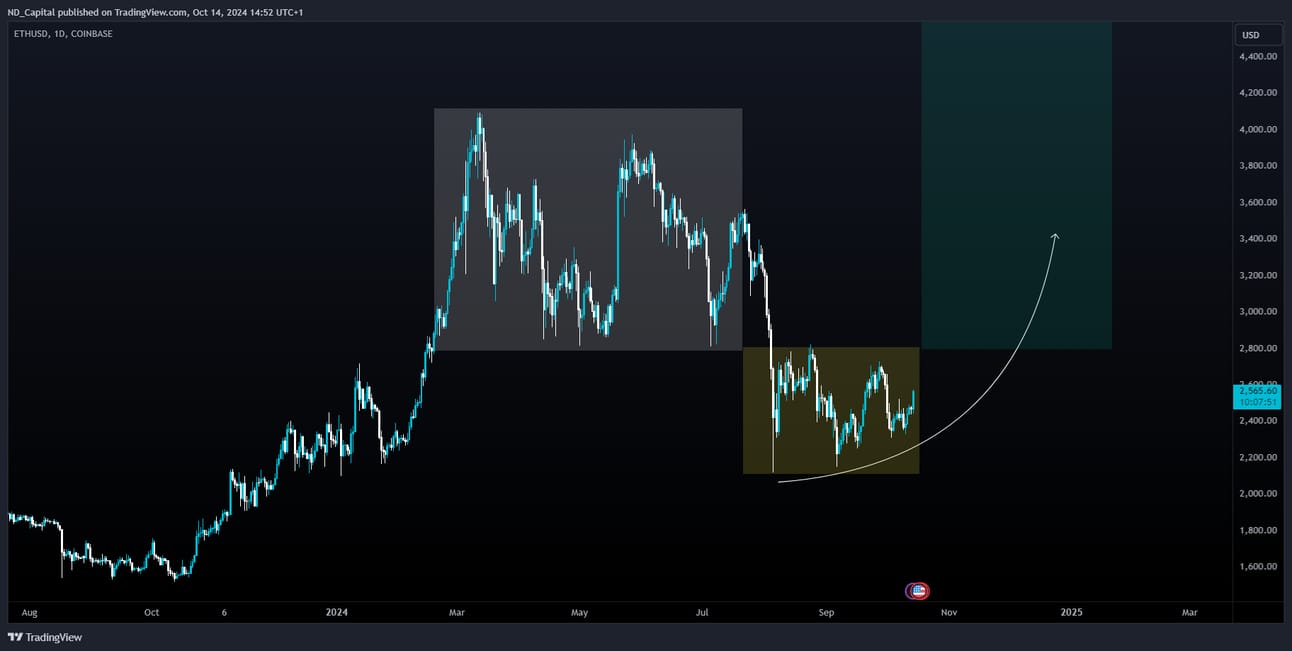

Ethereum - The forgotten Silver of Crypto

Yearly Development

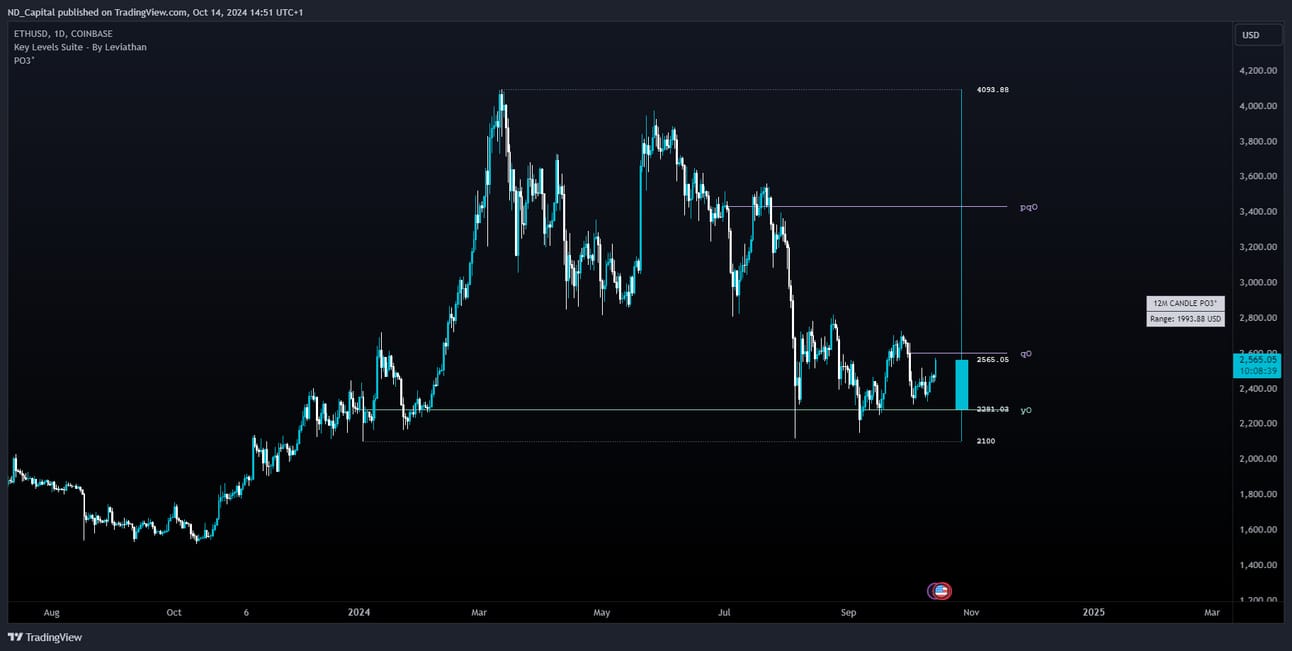

Clean VA Acceptance = 95% probability of rotating to the POC

Followed by 75% probability of rotating to the VAH and taking out the Q1 High.

Bullish Fundamentals - People dont like ETH and have forgotten about it. While Where the biggest and newest Altcoin this cycle PEPE? -ETH

Where the Trump/Elon coin is created? -ETH

Which one has an ETF? -ETH

Low Volume between 2.700 and 2.900 indicating a quick move might occur.

Multiple Yearly Open tests

Very nice HTF AMD / PO3 Play.

Nice higher lows with absorbtion in between them

Bulls take the stairs, bears take the elevator. Thats why I like the Higher lows building and slow grinding towards 2700

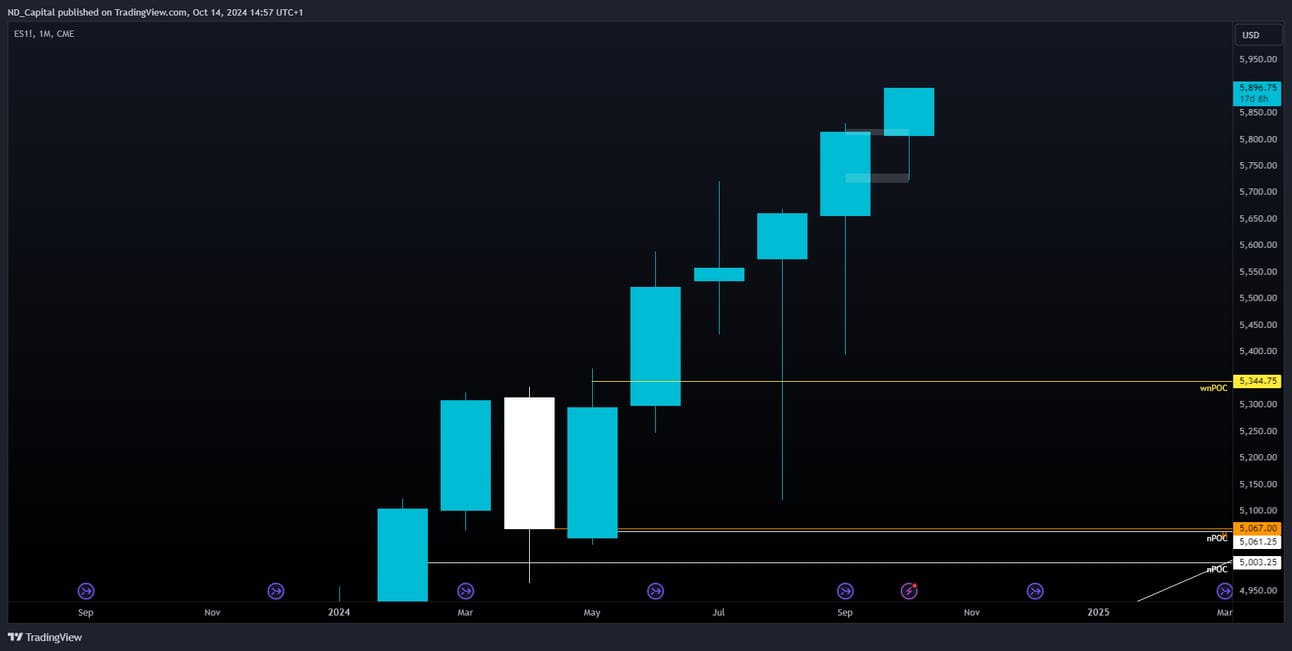

ES1! - The Big Dawg

Consolidation → Expansion

Hard to be bearish here. 6000 Dollars incoming

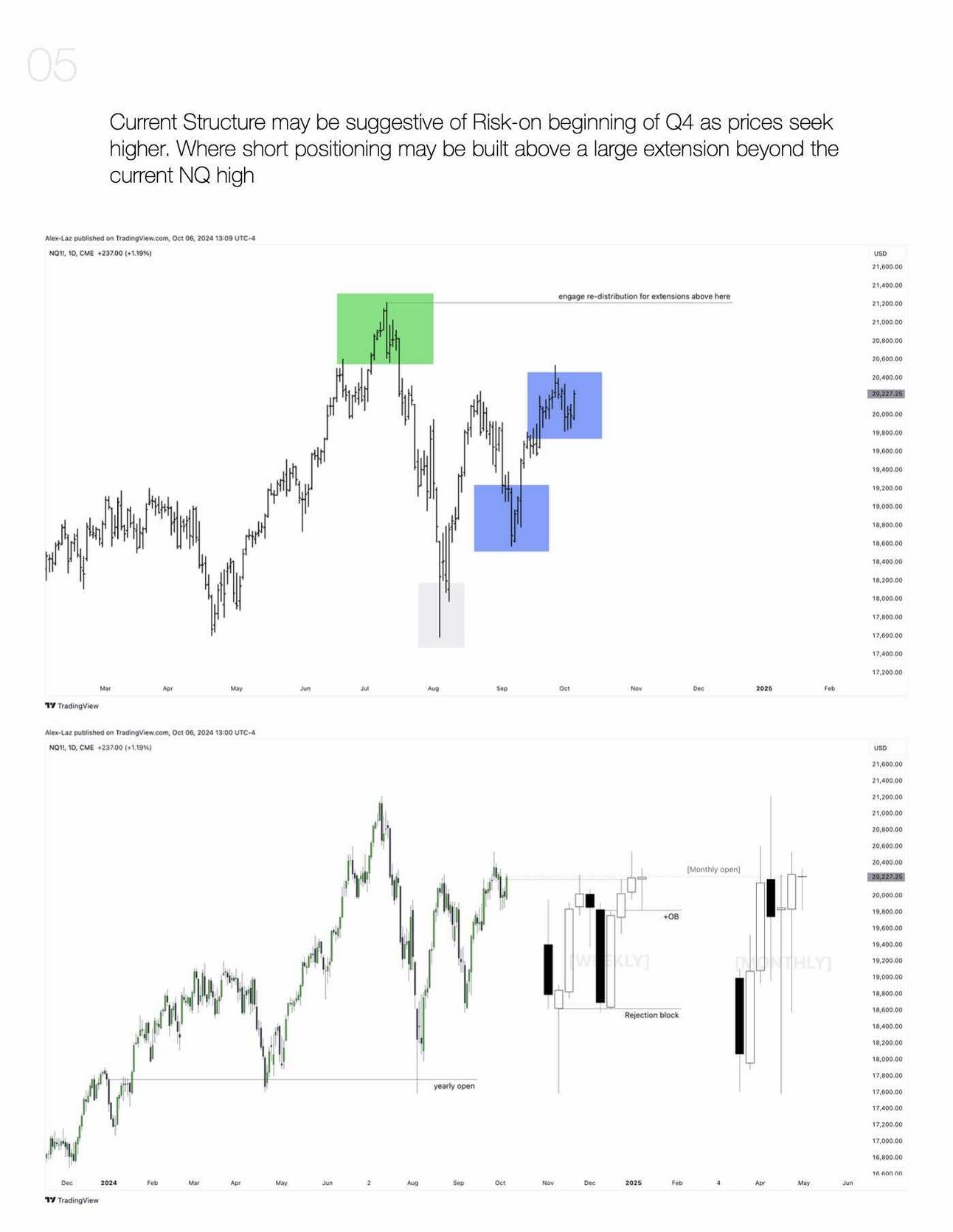

NQ - The lagging Tech behind ES

On its way to 21.5k - 5% away. As markets are pricing in D. Trump as the new US President we will contiue to see everything climbing higher in my personal opinion.

My personal portfolio

24.09. purchases shared in the network. Oh yeah.. This was the bottom again…

The Psychological Stages of a Trend

Stage 1: The Skeptics' Ball

- New trends in the meta are greeted with the kind of enthusiasm usually reserved for a root canal.

- Most folks cling to what they know, betting against the tide like they're holding a grudge against change.

- A daring few start whispering about the new wave, only to get reactions ranging from "meh" to "you've lost it."

Stage 2: Crescendo of the Crowd

- Gradually, like a slow clap turning into a standing ovation, people start hopping on the new meta bandwagon as it proves its worth.

- Bets start small, like testing the water with a toe, then dive in headfirst as confidence builds.

- A vicious cycle of "see, I told you so" kicks in, reinforcing the trend.

- Even when nearly everyone's nodding in agreement, some contrarians pop up thinking, "If everyone's jumping off the bridge, I'll just walk, thanks."

Note: Betting against the grain works when the trend's getting tired, not when it's sprinting.

Stage 3: The Great Divide

- As time marches on, the market gets drunk on its own success, with players throwing caution (and their money) to the wind, betting like there's no tomorrow on the current trend.

- The trend, however, starts doing the equivalent of a marathon runner hitting the wall; less oomph, more limp.

- Here we see a bizarre scene: sky-high confidence paired with ground-level momentum.

- The decline kicks off, teaching us that the best time to go all-in is when everyone else thinks you're nuts.

- Stick with your bets as the crowd trickles in, but start tapering off as the once-skeptical become recklessly confident.

- Sentiment fades are your cue to act when the market's volume goes up, but the speedometer starts dipping. That's when the crowd's roar could lead to their downfall.

- Remember, the market screams the loudest and bets the heaviest right when it should probably quietly sneak out the back door.

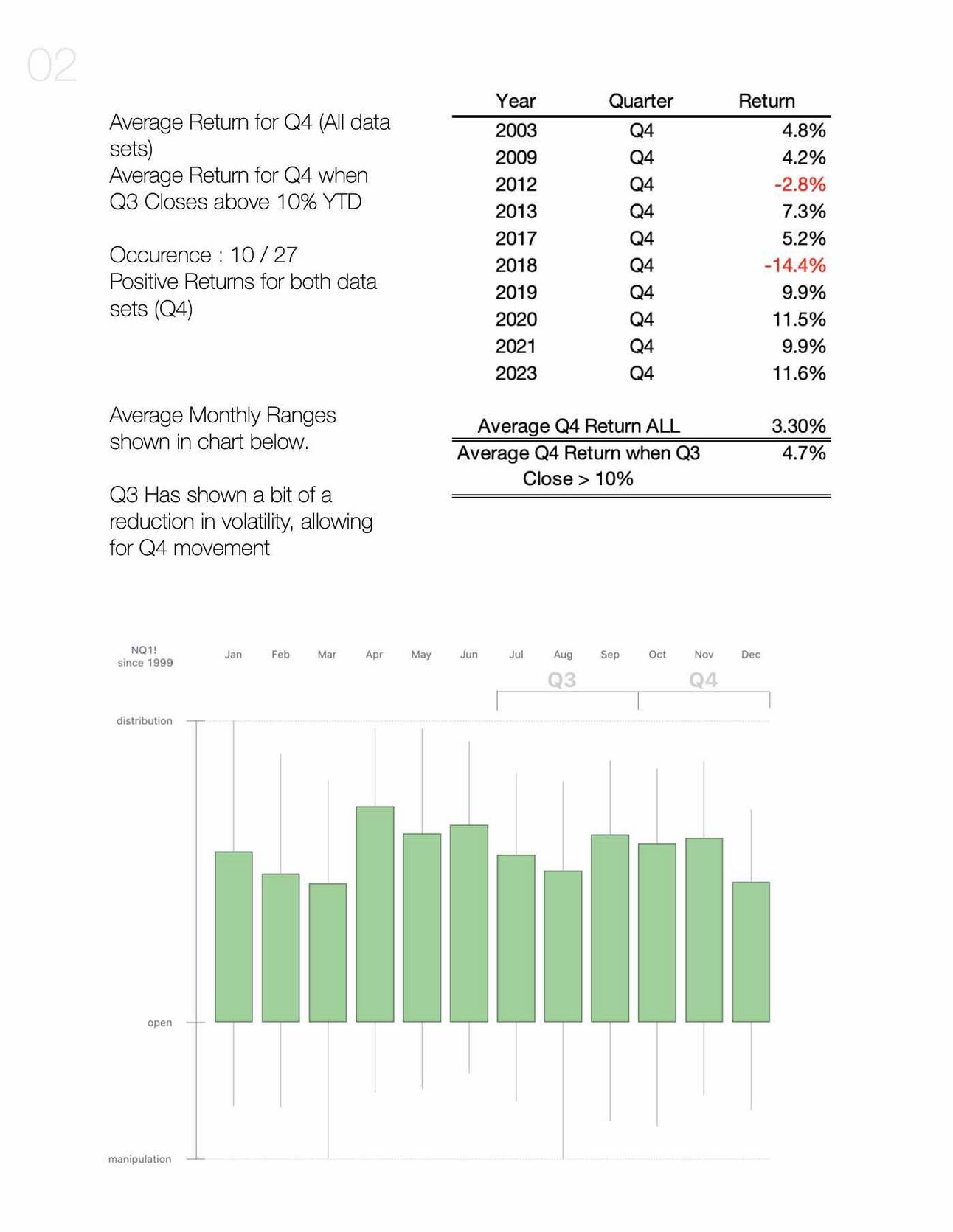

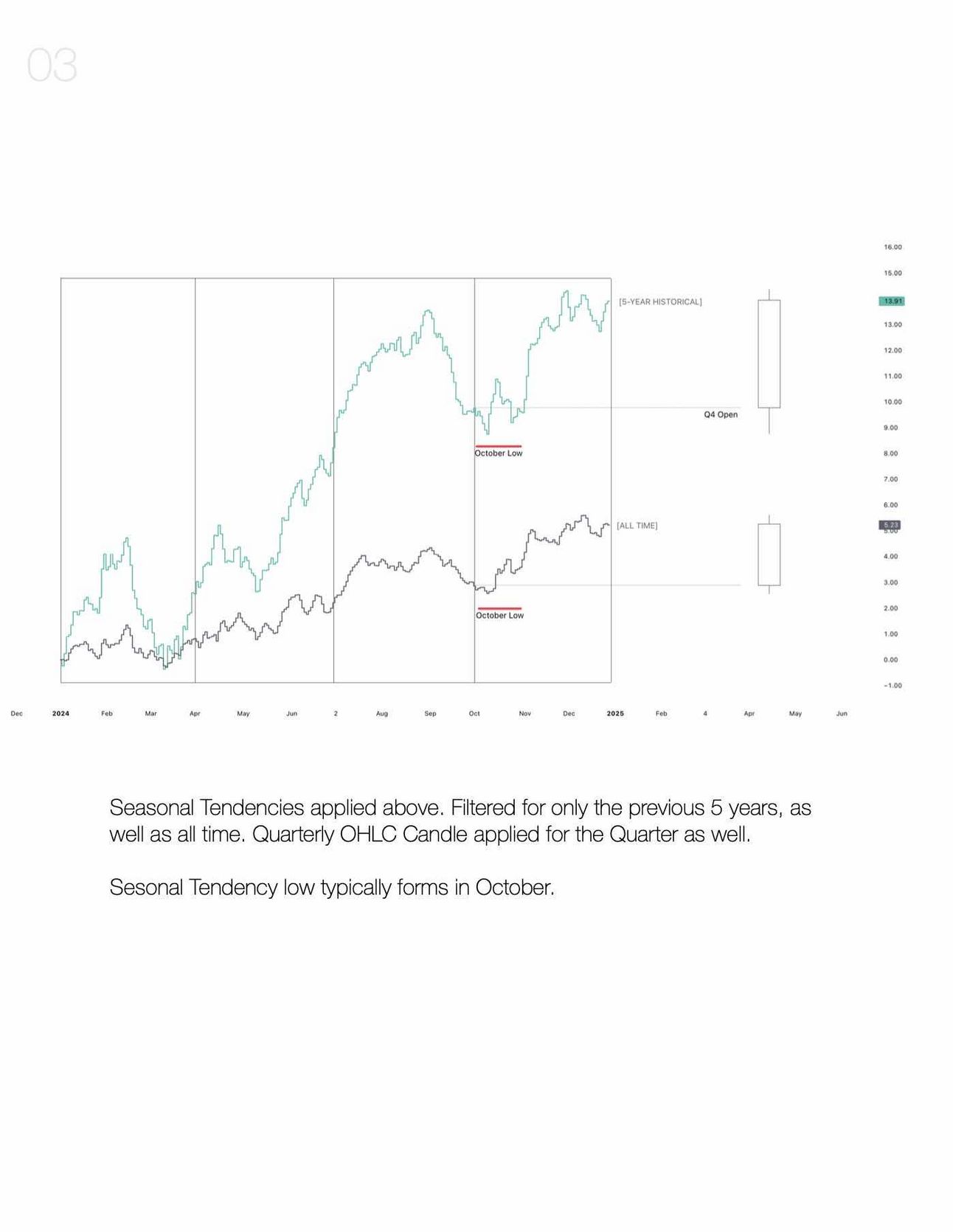

Seasonality and the truth behind it

Seasonality: The Market's Secret Beat

Here's the kicker that trips up many a trader: Seasonality.

While those big, sweeping macro trends might take their sweet time, like a slow dance that lasts years...

You've still got to get your groove on with the shorter beats – think daily or 4-hour charts.

And guess what? Seasonality is like the DJ of the market, spinning tracks that dictate when it's time to buy or sell. Here's the rhythm:

- Q2-Q3 Blues: Historically, these are the yawn-inducing, bear-tastic quarters for Bitcoin. With only 14 years of data, it's not ancient history, but it's the best beat we've got.

- The Strategy: Snag your Bitcoin in September when everyone's back to school and selling, then cash out in March when tulips start popping and so do your profits. Skip town, enjoy your gains, and come back next fall to do it all over again.

- This Year's Chart: Take a peek at Bitcoin's current chart, and you'll see this seasonal salsa worked like a charm yet again.

So, sync your market moves with the seasons, and you might just find yourself dancing to the bank.

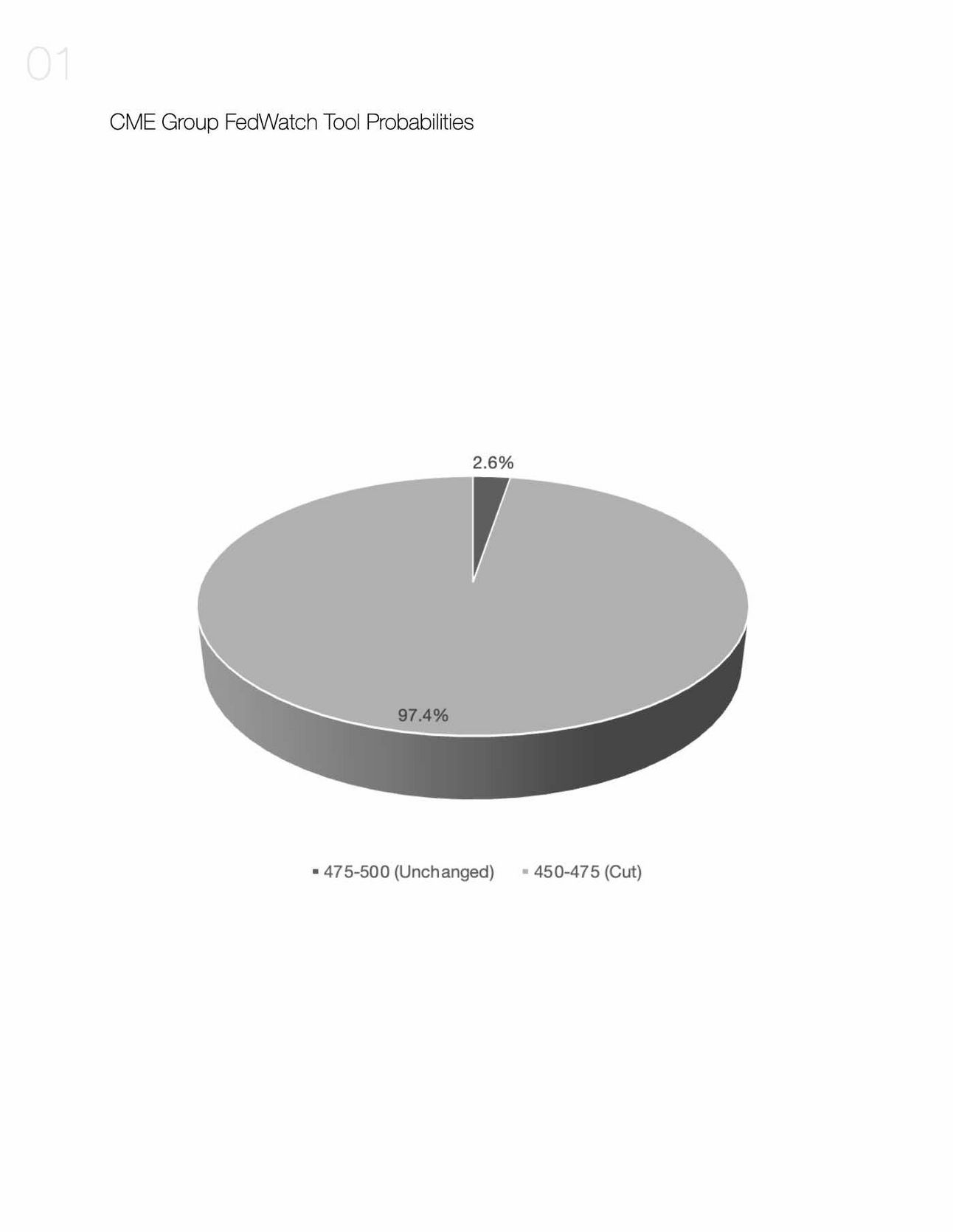

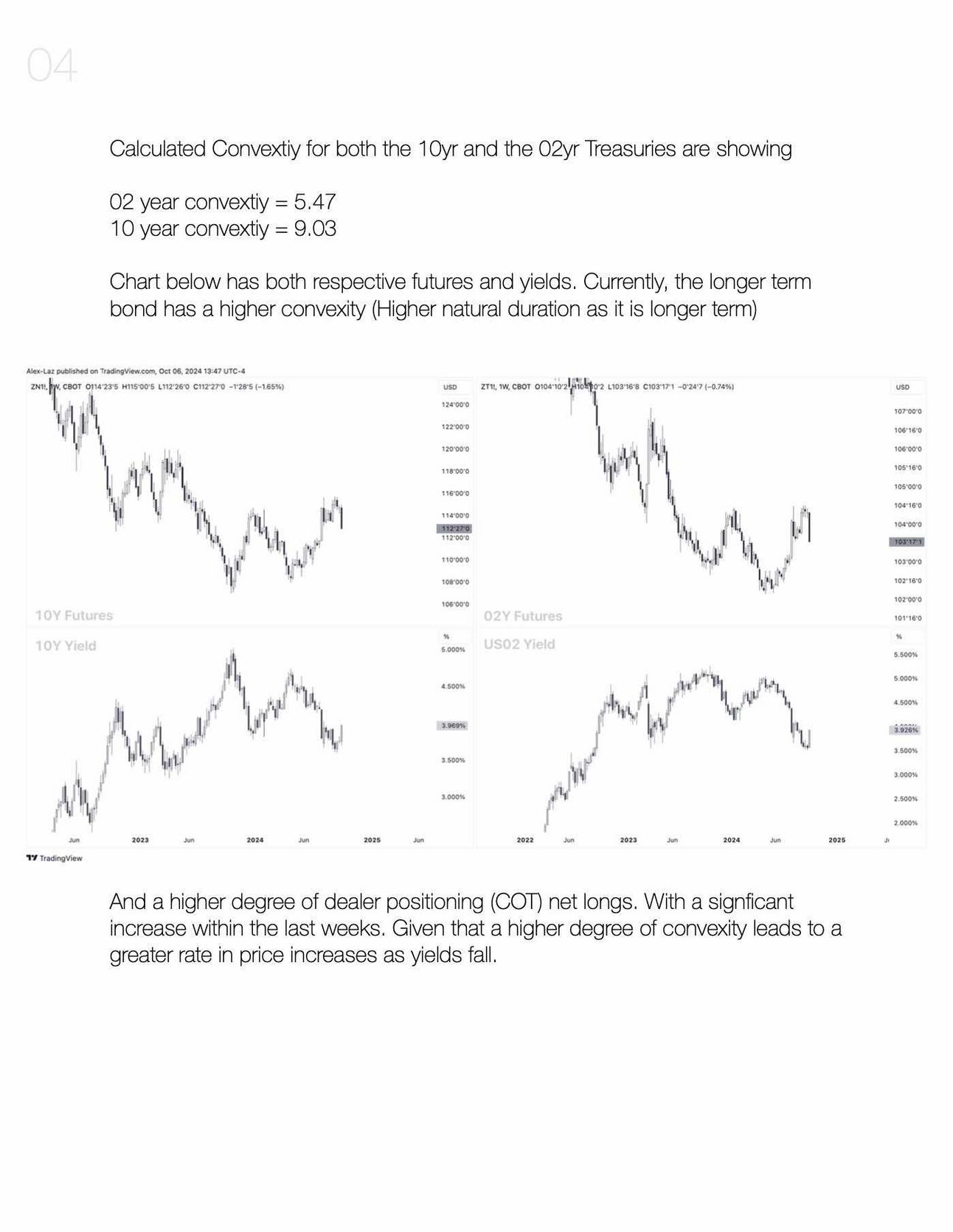

Fed Rate Cuts and NASDAQ Statistics

My suggestion

Go on x.com , follow my profile and click the bell…

You will get the most real time data updates regarding my posts.

https://x.com/NDaskalov28

I wish you the most fruitful Q4 of your life. Peace and abundace wishes! Stay blessed 🍀