- ND Capital Network

- Posts

- How to make silly amounts of money in the next few months...

How to make silly amounts of money in the next few months...

We’ve already established that the bull market is going to continue in full swing.

But now the question comes:

What to focus on?

The answer:

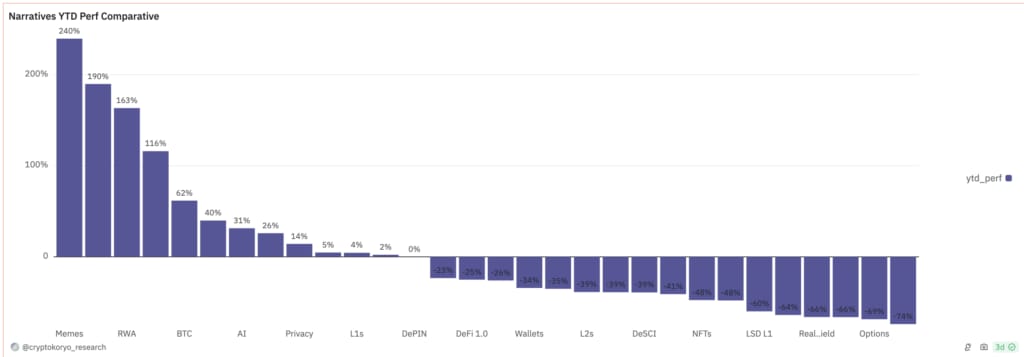

Focus on the coins that’ve already performed well.

Historically, every coin that out-performs in the first half of a bull market tends to repeat in the second half of the run.

So, in this case, we’re talking:

Memecoins (WIF, POPCAT, GIGA, PEPE, BONK)

RWA + LSD (PENDLE, OM)

AI (TAO, FET, RNDR)

In fact, so far in this second half of the run…

Memecoins have been the first to recover the losses from the past 6 months’ retracement and make new all-time highs.

This trend will only continue, since the first-half of every bull run shows you a prelude of what happens in the second half.

If I had to pick one to focus on though… it’d have to be memecoins.

It’s shown time and time again that the best returns can be acquired through this sector during this run.

Bull market playbook

Low trade frequency.

Delusional targets.

High conviction.

LARGE size.

Wide stops.

Long holds.

Market efficiency

When a market becomes big and efficient, there no longer exists opportunities to make big money.

Think stock markets

You’re still early in crypto, so take advantage of it.

The most advanced investing/trading skill

Is not some fancy technical analysis method.

Coding your own indicator.

Or even some algo.

It’s something much simpler:

Knowing when to go risk on/off and actually being able to execute that mode change.

Although, this shouldn’t be a surprise.

Especially when you think about the biggest reasons why you weren’t able to make money in past bull runs, or why you lost money in bear markets.

Chances are, you either:

Went risk-on/off when you weren’t supposed to (wrong timing)

Knew when to switch modes but failed to and ended up making less money than you should’ve or lost more money than you should’ve

It wasn’t a matter of technicals or even knowing what to buy/not buy.

You would’ve been 10x more successful if you knew when to throw $50k into a project vs. average in at $1k increments.

You would’ve also gotten 50x the results if you knew when to scale in hard vs scale out hard.

And as you can observe…

These shifts are not technical, but rather psychological.

Which seem simple enough to do, but is much harder in reality.

This is why there’s the saying that trading is 90% psychology.

It really is.

Nick XBT

P.S. Make sure you are inside the Telegram (Exclusive Drops) → https://t.me/ndcapitalnetwork